Real Estate Regulation and Development Act (RERA) is a landmark legislation in India aimed at protecting the interests of homebuyers and ensuring transparency and accountability in the real estate sector. While most people are familiar with the role of promoters and developers under RERA, there is another key player in the game – the co-promoters. In this blog post, we will delve into the concept of co-promoters under RERA and their significance in real estate projects.

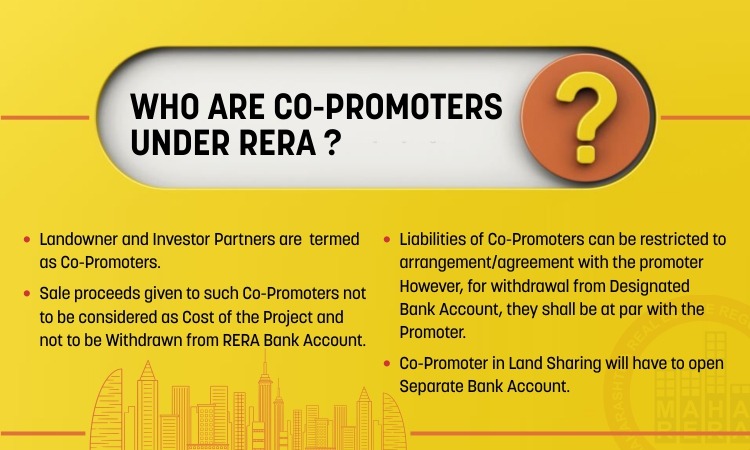

Who are Co-Promoters Under RERA?

Co-promoters under RERA are individuals or entities who partner with the primary promoter or developer in a real estate project. Typically, co-promoters fall into two categories:

Landowner Partners: These are individuals or entities who own the land on which the real estate project is being developed. They enter into a partnership with the primary promoter to develop the land into a real estate project.

Investor Partners: Investor partners are those who provide financial support to the primary promoter for the development of the project. They may invest capital into the project but may not necessarily own the land.

Significance of Co-Promoters

Co-promoters play a crucial role in real estate development, and their involvement has important implications, both legally and financially. Here are some key points to understand:

Exclusion from Project Costs: One of the significant aspects of co-promoters is that the proceeds received by them are not considered as part of the project costs. This means that the funds given to co-promoters are not included when calculating the total cost of the project.

Withdrawal from RERA Bank Account: Since the funds provided to co-promoters are not considered project costs, they cannot be withdrawn from the RERA bank account. This measure is in place to ensure that the project’s financial integrity and transparency are maintained.

Liabilities of Co-Promoters: Co-promoters’ liabilities are often defined in agreements with the primary promoter. While they may have limited liability as per their arrangement, when it comes to withdrawing funds from the designated bank account, they are treated on par with the primary promoter. This ensures that the financial obligations of the project are met collectively.

Separate Bank Account in Land Sharing: In cases where co-promoters are involved in land-sharing arrangements, a separate bank account is mandated. This separation helps maintain transparency and accountability in the financial aspects of the project.

Conclusion

In the world of real estate development under RERA, co-promoters are significant stakeholders. Landowners and investor partners contribute their resources and expertise to bring real estate projects to fruition. Understanding their roles, liabilities, and the financial implications of their involvement is crucial for both primary promoters and homebuyers.

As a primary promoter, it is essential to establish clear agreements with co-promoters to define their responsibilities and liabilities. For homebuyers, knowing that the funds provided to co-promoters do not affect the project costs provides an additional layer of transparency and assurance.

In conclusion, co-promoters are integral to the real estate landscape governed by RERA, and their role should not be underestimated in ensuring the success and transparency of real estate projects in India.